Bankrate, Freddie Mac: Mortgage rates in holding pattern

By Palm Beach Business.com

DELRAY BEACH — For a second week in a row, mortgage rates pretty much did nothing. But then that’s pretty much what they’ve been doing for the past year.

DELRAY BEACH — For a second week in a row, mortgage rates pretty much did nothing. But then that’s pretty much what they’ve been doing for the past year.

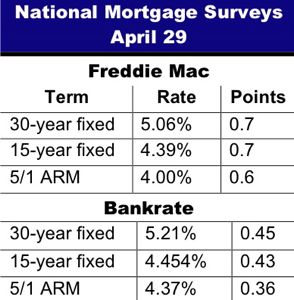

Freddie Mac’s Primary Mortgage Market Survey, released Thursday, spotted the 30-year fixed-rate mortgage averaging 5.06 percent with an average 0.7 point, compared with 5.07 percent a week earlier.

Bankrate’s national mortgage survey put it at 5.21 percent with an average 0.45 point, down from last week’s 5.22 percent.

"Mortgage rates on 30-year fixed loans have averaged about 5 percent over the first four months of this year, staying within a band of roughly a quarter percentage point and virtually matching 2009’s annual average," said Frank Nothaft, Freddie Mac vice president and chief economist.

Said Bankrate: The Federal Reserve is holding interest rates low, showing no indication of raising them and no inclination to sell their substantial holdings of long-term Treasury notes. Mortgage rates are closely related to yields on long-term government debt.

By the Fed holding steady, mortgage rates are holding steady, showing very little movement in the past two weeks. Mortgage rates have also been largely unaffected since the Federal Reserve's $1.25 trillion mortgage buyback program came to a close at the end of March. The average 30-year fixed mortgage as of March 31 was 5.23 percent and today it is 5.21 percent.

Bankrate’s panel of mortgage experts sees the holding pattern most likely continuing in the near term: 53 percent of the panelists see rates moving little over the next week or so, while 31 percent believe rates will rise. The remaining 16 percent say rates will fall.