Mortgage rates inch higher in South Florida

By Palm Beach Business.com

DELRAY BEACH — Mortgage rates moved modestly higher over the past week, moving in step with bond yields, according to Freddie Mac and Bankrate, while taking a slightly bigger jump in South Florida.

DELRAY BEACH — Mortgage rates moved modestly higher over the past week, moving in step with bond yields, according to Freddie Mac and Bankrate, while taking a slightly bigger jump in South Florida.

Freddie Mac’s Primary Mortgage Market Survey found the 30-year fixed-rate mortgage averaging 4.99 percent with an average 0.6 point compared with last week’s 4.96 percent. Bankrate said the 30-year is averaging 5.11 percent with 0.41 point, up from 5.07 percent a week ago.

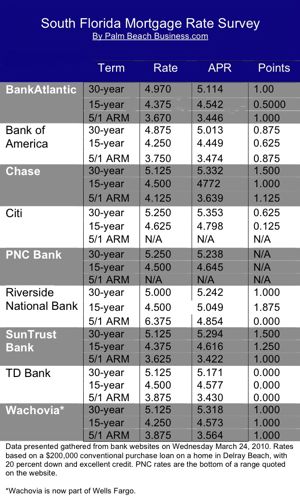

Palm Beach Business.com’s South Florida Survey found 30-year mortgage rates averaging 5.094 percent, with 1.125 points, up from 4.946 percent last week. Most surveyed banks raised their rates, with only BankAtlantic with an offering below 5.00 percent.

Over the week, yields on the 10-year treasury bonds, the benchmark for interest rates, jumped to 3.84 percent from 3.65 percent a week earlier.

Freddie Mac spotted the 15-year averaging 4.34 percent with an average 0.6 point, up from last week’s 4.33 percent. A year ago at this time, the 15-year FRM averaged 4.58 percent.

Freddie Mac put the 5-year adjustable-rate mortgage at 4.14 percent this week, up from 4.09 percent. A year ago, the 5-year ARM averaged 4.96 percent.

Bankrate said the average 15-year fixed mortgage bumped up to 4.47 percent while the average five-year ARM climbed to 4.49 percent.

“Mortgage rates inched up slightly this week as bond yields rose even further,” said Frank Nothaft, Freddie Mac vice president and chief economist. “Interest rates on 30-year fixed mortgages, however, were still below 5 percent for the fourth consecutive week.

“Household debt burdens on aggregate continue to improve through the end of 2009. The Federal Reserve reported that the financial obligations for homeowners declined to under 16.1 percent of their disposable income in the fourth quarter, which represents the lowest share since the third quarter of 2003. Similarly, the obligations share for renters fell below 24.4 percent, the lowest since the end of 1993.”

Bankrate said favorable economic news nudged mortgage rates higher, and the downgrade of Portugal's credit rating coupled with an end to the Federal Reserve's mortgage bond purchase program spells more volatility on the horizon.

In fact, 75 percent of Bankrate’s panel of mortgage rate experts sees rates moving higher over the next week. Only six percent rates falling, while 19 percent expect rates will remain more or less unchanged.